Mitigation Banking Made Easy: Why You Need a Credit Broker on Your Side

Mitigation credit sales brokers play a crucial role in the industry. They connect buyers and sellers, negotiate credit sales, and ensure compliance with regulations. Whether you’re a banker, a developer, or an investor, working with a sales broker can help you. They navigate the complex processes of buying and selling credits, and buying, selling, or starting a mitigation bank.

By utilizing their knowledge and expertise, you can save time and money while ensuring that your project achieves success. Let’s delve into the role of the sales broker in the mitigation banking industry.

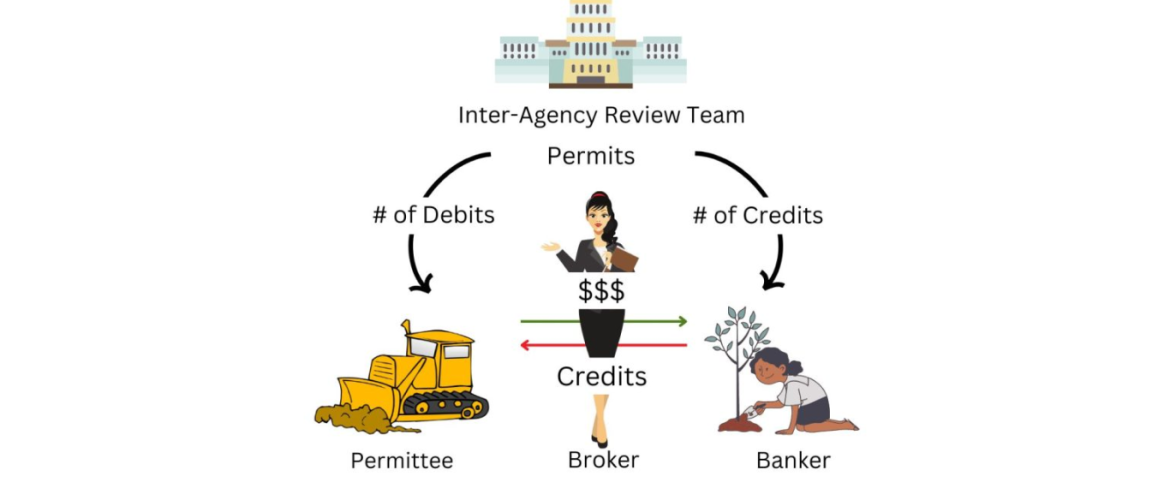

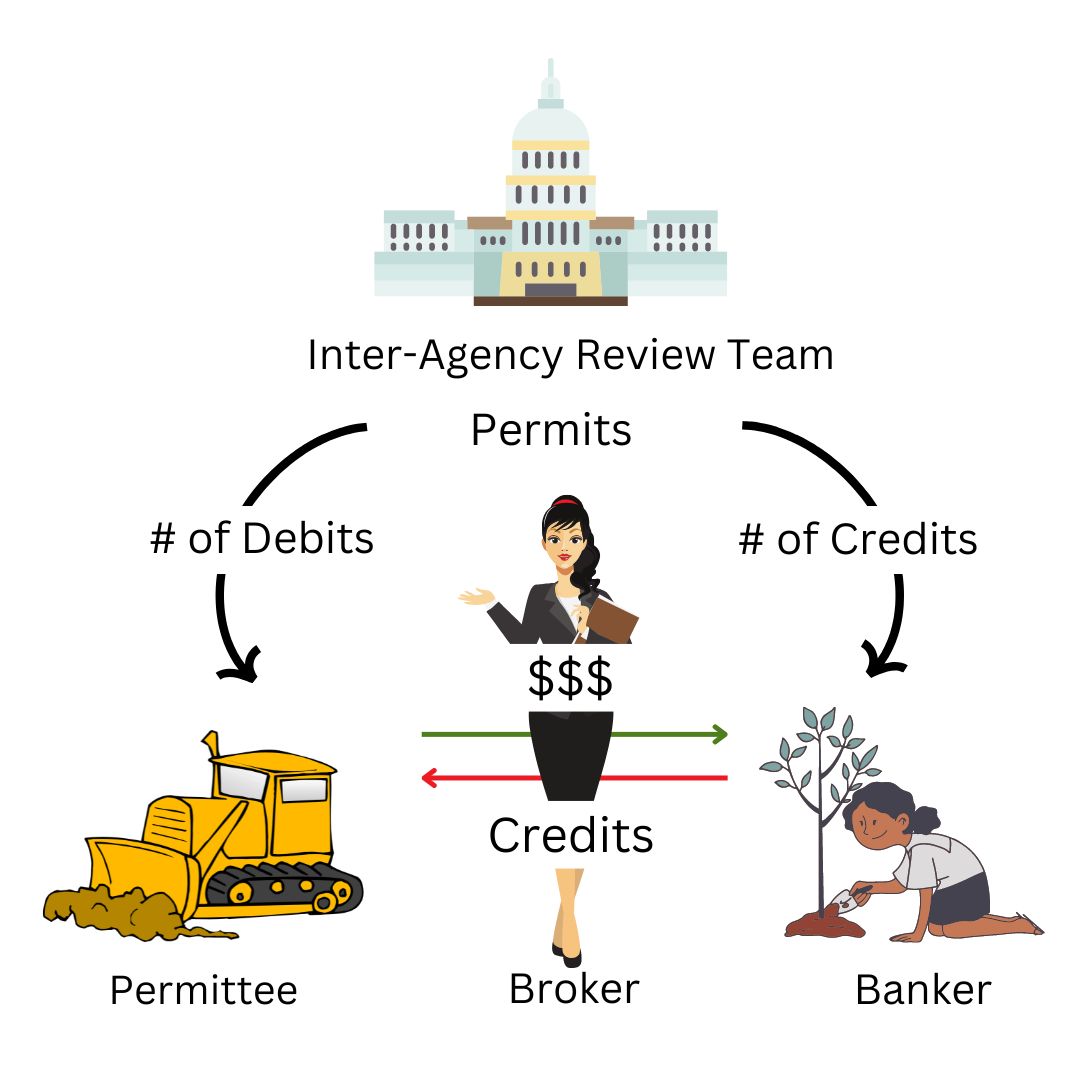

The role of a mitigation banking sales broker in environmental regulation

Mitigation banking is a heavily regulated industry. The US Army Corps of Engineers (USACE), the US Fish & Wildlife Service, the EPA, and associated agencies on the state and regional level all have their hands in regulating the impacts of construction on wetland ecosystems and endangered species habitats. This can create a compliance mess.

Mitigation sales brokers contribute to key parts of the compliance workflow for both developers and bankers. In an industry where regulation eats up a lot of your resources, the efficiency of a mitigation credit sales broker can make a world of a difference.

The importance of a mitigation credit sales broker in environmental credit markets

All of this regulation creates a framework in which the business of mitigation banking takes place. The government plays a role in the supply and demand of mitigation credits, yet there is also an independent environmental market. This market determines the costs and value of these biodiversity credits.

Like all environmental markets, and markets in general, knowledge of your risk and reward helps inform what investments you make. This investment might be in a bank or in a development project. Without sales brokers, it’s difficult to forecast your risk and reward.

Understanding mitigation banking & credit brokerage services

Mitigation banking brokers conduct market studies to determine the demand for mitigation credits.

These studies help prospective bankers determine potential profitability of a mitigation banking project. They also help developers determine the feasibility of their proposed project.

The sales broker helps credit buyers, regulatory agencies, landowners, and real estate agents. They provide leads and guide all parties through the credit sales process, making sure that the negotiation and price are agreed upon. Because of their vast connections, mitigation credit sales brokers are valuable throughout the life of a bank or development project.

When working with a sales broker, it is also crucial to be open to their advice and guidance. Brokers have a wealth of knowledge and experience in the mitigation banking industry. Their recommendations can help you make informed decisions.

Why developers and bankers need a mitigation banking sales broker

For developers, having a broker can help ensure access to the credits they need. If you are a developer looking to buy credits, working with a sales broker can streamline the process and ensure that you get the best deal possible.

For mitigation bankers, having a broker can ensure that you are getting the best return on your investment. Brokers help mitigation bankers understand the competitive landscape, identify pricing trends, and set the right price for their credits. This can help mitigation bankers maximize their returns on their investments.

The timely buying and selling of credits needs to be carefully watched by both bankers and developers. Developers cannot start work until bankers have updated their public and private ledgers accounting for their credits. Bankers cannot realize the return of their financial assurances until credits are sold. Mitigation credit brokers work under the time pressure of both stakeholders.

Key services provided by mitigation banking credit brokers

To make the most of your partnership with a sales broker, communicate your needs clearly. Be honest about your goals, your timeline, and your budget. By doing so, your broker can create a customized plan from the mitigation banking brokerage services that they offer.

Connect bankers to buyers & lead generation

Sales brokers connect mitigation bankers with developers to offset environmental impacts. They create marketing strategies that raise the visibility of a banking project. This results in quicker credit liquidation rates. For developers, brokers know the credit inventory in the area. This streamlines the process of discovery.

Mitigation banking brokers help clients price mitigation credits. They base this pricing on market conditions, regulatory requirements, and other factors at the point of sale. Sales brokers negotiate credit sales, helping to ensure that the price and other terms of the sale are agreeable to both parties. They also facilitate payment once all permits are acquired so that no time or money is lost at the final stage of negotiation.

Market feasibility & planning consulting

Sales brokers’ expertise and knowledge of historical pricing, feasibility, market analysis are essential, especially in the early planning stages of both mitigation banking plans and environmental impact assessments.

They can connect bankers and developers to the right environmental consultants experienced with site surveys and environmental assessment for mitigation banking.

Environmental due diligence services

Both types of projects need to submit paperwork outlining their impact and projected costs before approval. A broker’s knowledge of historical and current pricing, as well as current permitted activity and competition, is invaluable at this step.

They help development projects with due diligence by matching their offset to an available credit. They help banks with due diligence by advising on what credits they can sell.

Once the sale is complete, sales brokers adjust your public credit ledger at the state and federal levels. They can give you advice on how best to maintain your credit ledger and keep your accounting up-to-date so that you never have an issue that delays sales.

Eminent domain consulting & credit adjustments

Mitigation banking brokers provide guidance on eminent domain issues. If you lose credits due to eminent domain, a sales broker can help adjust your conservation easement to account for the loss. They can also provide services for the transportation agency to navigate this process.

Site location consulting

Mitigation credit sales brokers help to identify potential mitigation banking sites. They can advise on sites that offer the highest environmental benefits and the best return on investment. Sales brokers who have knowledge on market saturation can assist you in determining whether there is or will be demand for your bank.

Our website offers resources, including a drainage basin map and service area map, to help clients identify the most lucrative properties for siting wetland mitigation or conservation banks.

Ecological asset valuation

If you’re unsure whether your land has any ecological or restoration value, sales brokers can help value your ecological assets. They educate landowners on whether their property has extra conservation or mitigation value.

Mitigation bank property sales

Sales brokers even go so far as to broker the sale of mitigation and conservation banks in their entirety. If you are selling your bank, a sales broker can help determine the value of your conservation easement alongside your property. They can take on all of the marketing and sales aspects to get your bank sold. If you are looking to buy a bank, turn to a sales broker to see their inventory of mitigation banks for sale.

Why work with a mitigation credit sales broker?

Working with a sales broker can be beneficial for all parties involved in the mitigation banking process. Here are some reasons why:

- Expertise: Credit sales brokers are knowledgeable about the regulatory requirements, the credit sales process, and the market conditions. They can guide you through the process and help you avoid costly mistakes.

- Network: Sales brokers have established relationships with various stakeholders involved in mitigation banking, such as credit buyers, regulators, landowners, and real estate agents. They can leverage their network to help you find the best deals and connect you with the right people.

- Efficiency: Mitigation banking can be a time-consuming and complex process. Sales brokers can help streamline the process and make it more efficient, allowing you to focus on other aspects of your project.

How to choose the right mitigation banking sales broker

When choosing a sales broker, it’s important to consider their experience, industry relationships, and knowledge of the regulatory landscape. Look for a broker who can help you with every step of the process, from site selection to credit sales to compliance.

If you’re interested in working with a sales broker or learning more about the mitigation banking industry, reach out to us. With the right guidance and support, you can take advantage of the many benefits of mitigation banking, including financial returns, ecological conservation, and sustainable development.

Mitigation credit sales brokers are a key partner for developers and bankers alike

Mitigation credit sales brokers are experts in the field and provide valuable guidance and assistance to bankers, developers, and investors. By leveraging their key services, such as market feasibility studies, environmental due diligence, and credit pricing and sales consulting, clients can maximize their returns on investment. Whether you’re buying or selling credits, or looking to develop a new mitigation bank, working with a mitigation broker can help ensure your success in the industry.