The Premier Wetland Mitigation Bank Marketplace

Victoria Bruce links interested buyers and sellers of wetland mitigation banks throughout the country.

Victoria Bruce has leveraged her expansive network in the mitigation banking industry to connect sellers and buyers throughout the country.

She has facilitated the sale of prominent wetland mitigation banks, including the:

- Neoverde Mitigation Bank (2019), sold for $10.4 million with $32 million in mitigation credit assets.

- Crooked River Mitigation Bank (2019), sold for $3.57 million with $11.6 million in mitigation credit assets.

- Colbert Cameron Mitigation Bank (2020), sold for $5 million, boasting an impressive mitigation credit value of $8 million in mitigation credit assets.

- Yazoo Mitigation Bank (2023) Victoria coordinated a Joint Venture agreement to bring the mitigation bank in compliance after being Terminated.

- Ocklawaha Mitigation Bank (2024) (208 acres); which sold for $1.1 Million with $3.2 Million Dollars of Mitigation Credit assets.

In addition to connecting buyers and sellers, The Mitigation Banking Group, Inc. (MBG) offers comprehensive assistance during the due-diligence and acquisition process. We provide in-depth market analysis, examining current supply and historic demand in the specific region of interest.

Prospective mitigation bankers and investors rely on Victoria’s expertise and MBG’s resources for accurate historical analysis of mitigation credit sales and project data, helping to ensure a smooth and seamless entry into the market.

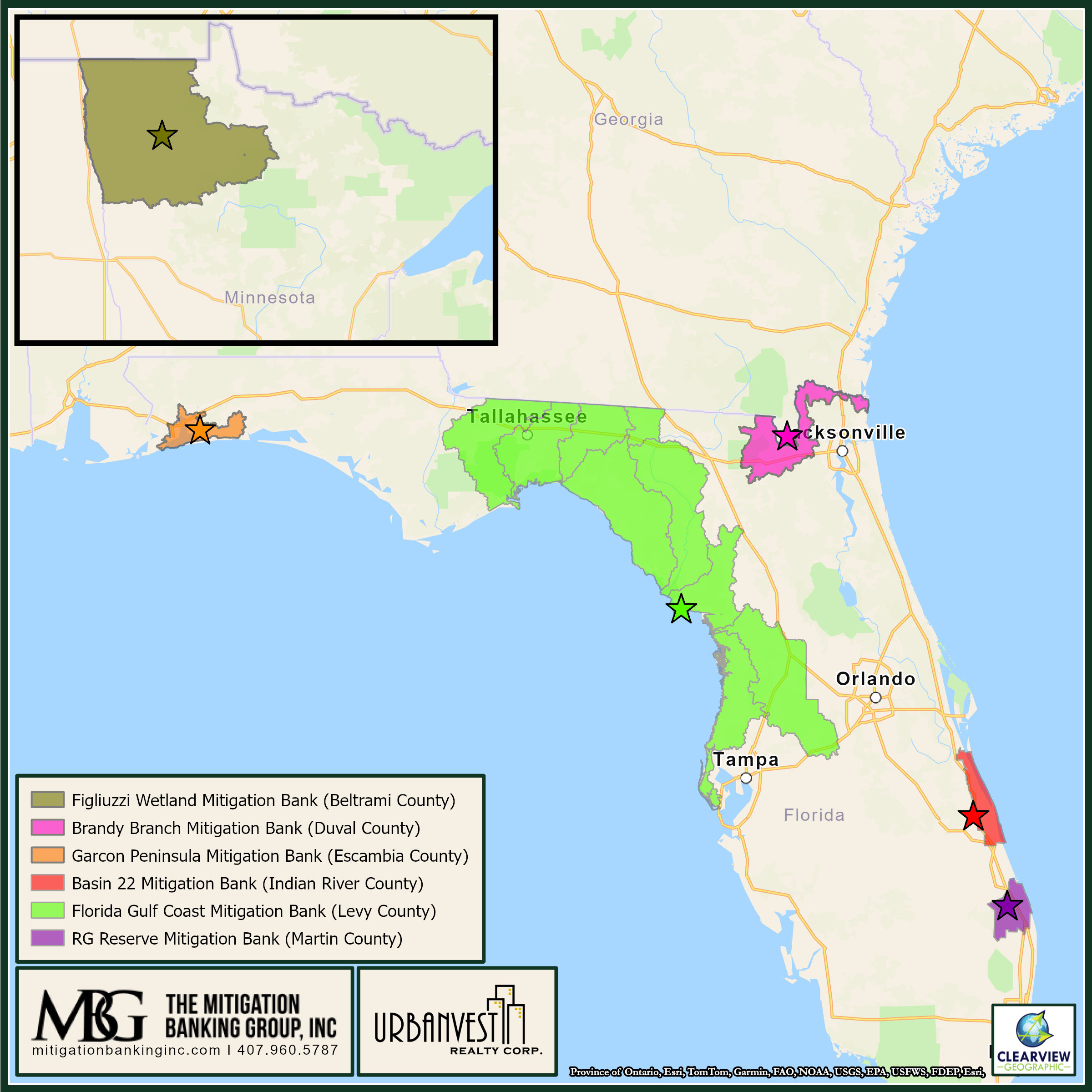

Brandy Branch Mitigation Bank

The Brandy Branch Mitigation Bank, located in Nassau County, Florida, encompasses 762.38 acres of ecologically rich wetlands along the St. Mary’s River. Offering extensive river frontage and serving as a key environmental asset, this bank is permitted by SJRWMD and USACOE and is an exceptional opportunity for investors committed to conservation and sustainable development. Additional land adjacent to the bank is also available, enhancing the potential for ecological impact and investment value. Contact Mitigation Banking Group, Inc. for exclusive pricing and investment opportunities.

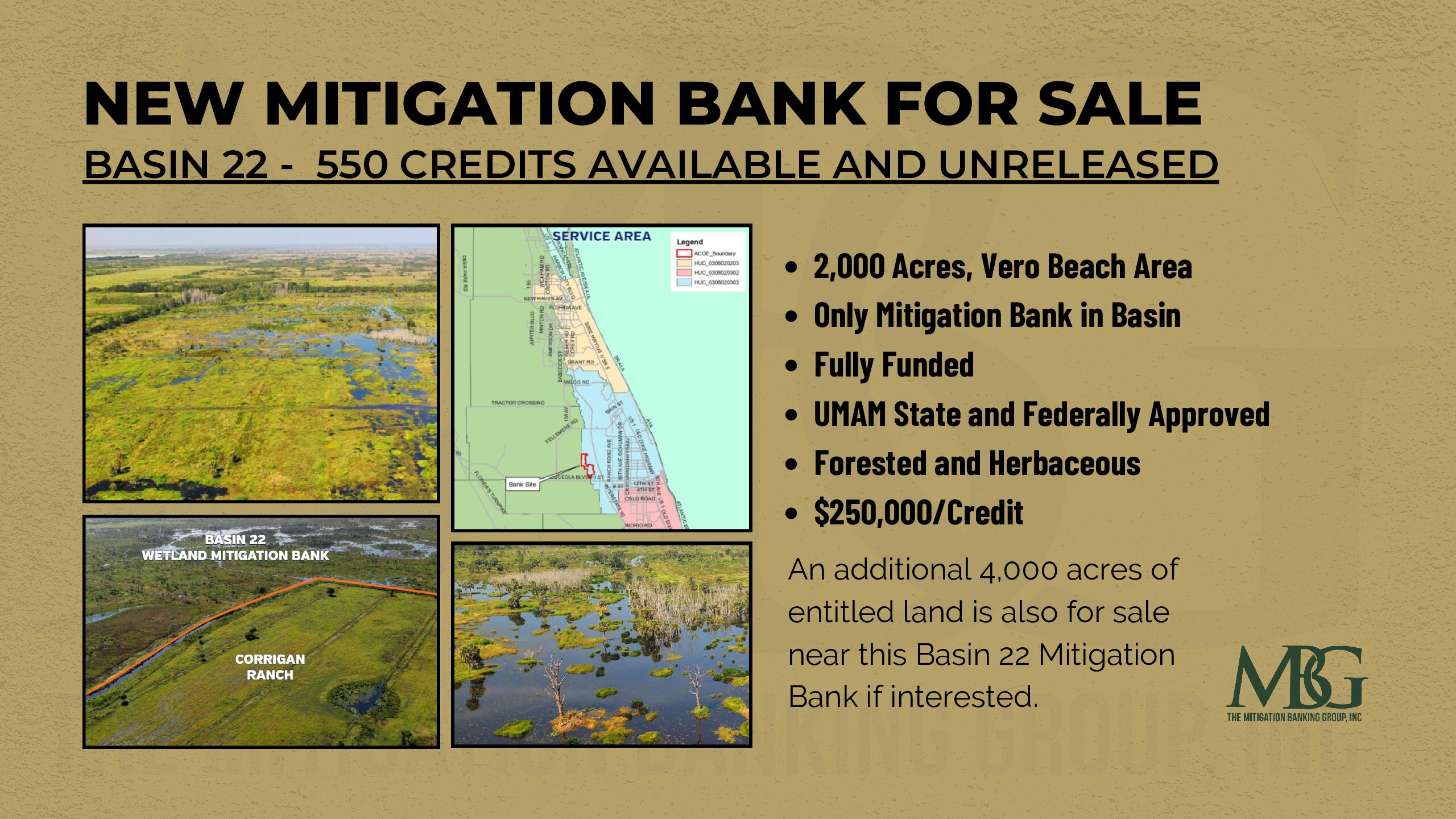

Basin 22 Mitigation Bank

Explore the unique investment opportunity at Basin 22 Mitigation Bank in the Vero Beach area, offering 550 credits within a 2,000-acre site, with an additional 4,000 acres available, starting at $250,000 per credit.

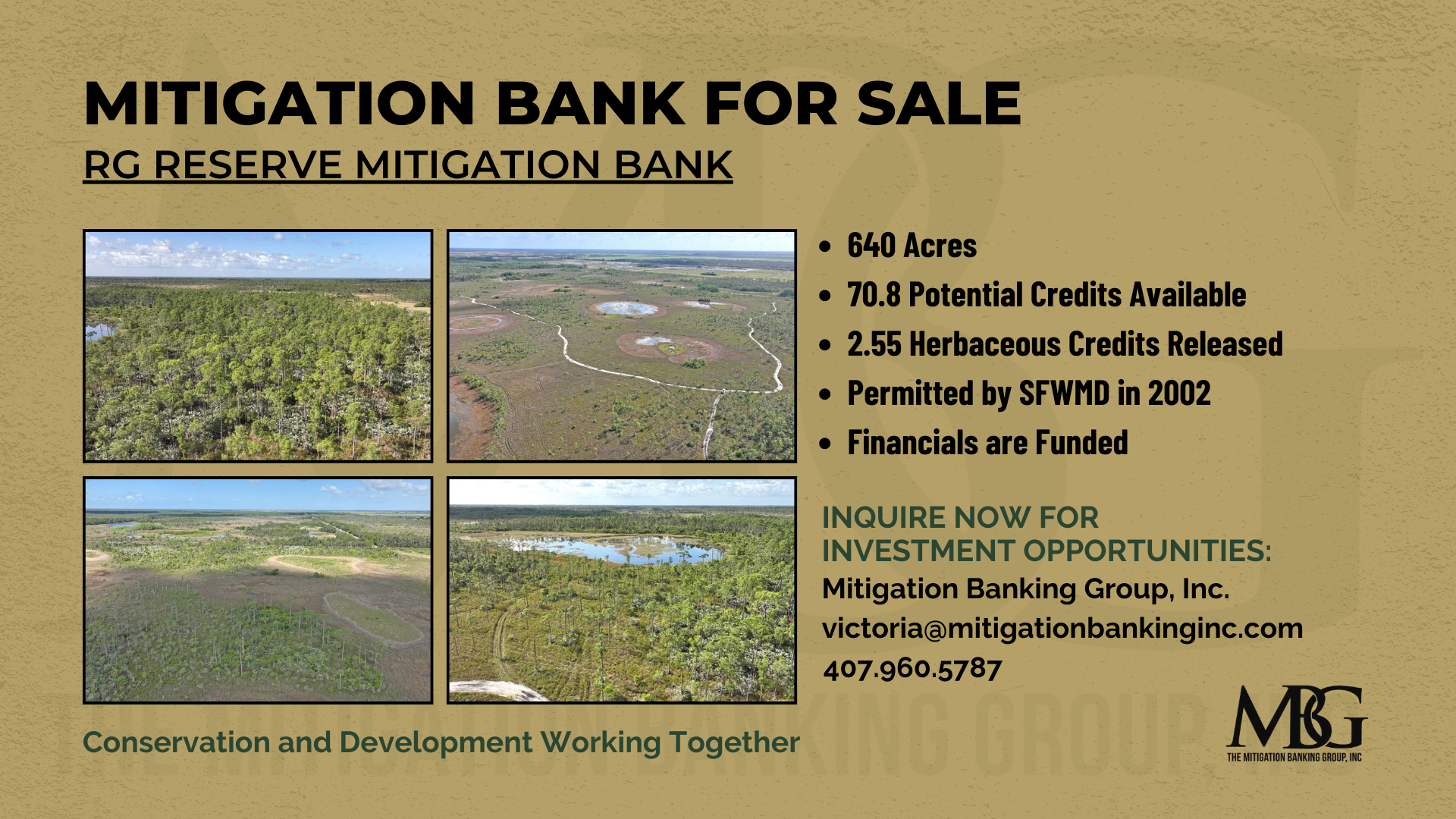

RG Reserve Mitigation Bank

Permitted by the South Florida Water Management District (SFWMD) in 2002, the RG Reserve Mitigation Bank offers a significant contribution to the ecological restoration efforts in Jupiter, Florida. Spanning 640 acres, this property is strategically positioned west of Jupiter on SW Pratt Whitney Road, serving as a crucial habitat for diverse Floridian wildlife.

Figliuzzi Wetland Mitigation Bank

Discover the Figliuzzi Wetland Mitigation Bank in Beltrami, Minnesota, offering 147.849 wetland mitigation credits across 167 acres in the Red River Watershed, valued at $2.5 million.

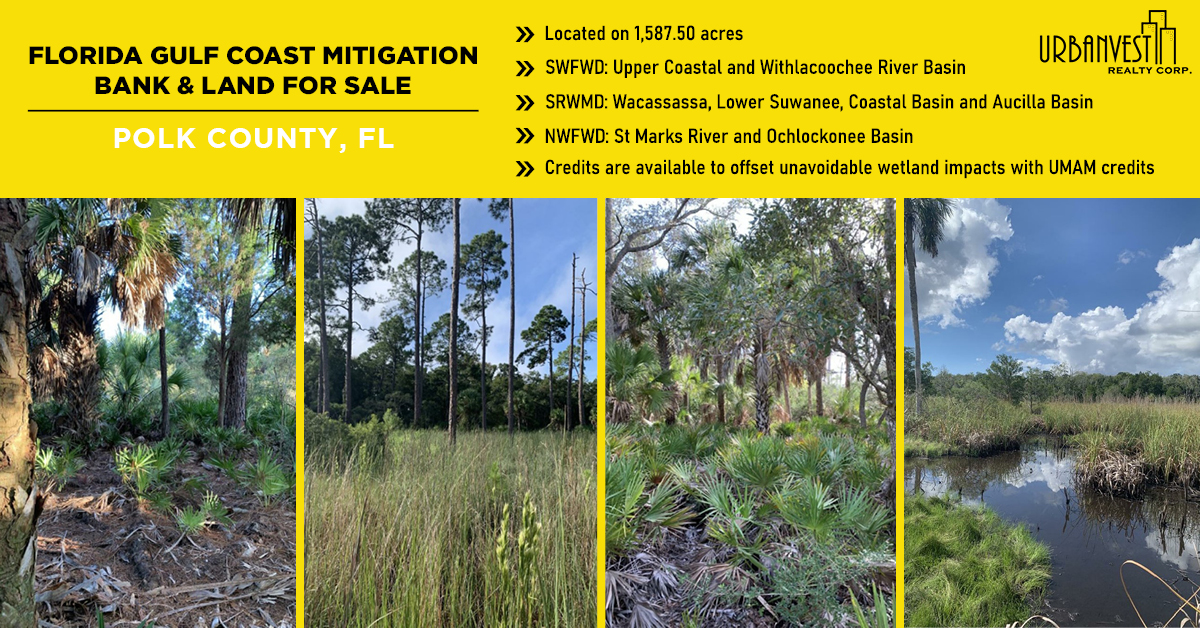

Florida Gulf Coast Mitigation Bank

The Florida Gulf Coast Mitigation Bank provides state and federal Freshwater Depression Marsh and Freshwater Forested credits within the Waccasassa River Basin, Suwannee River Basin, Coastal Rivers Basin and Withlacoochee River Basin within the Suwannee River Water Management District.

Note to Interested Investors:

Permitting a mitigation bank is considered a high barrier to entry industry and risky due to the indefinite permitting timelines, standards and other unknowns. Entering the marketplace with a fully functioning mitigation bank permitted by both state and federal agencies is a unique, valuable long-term asset, that awards you less risk and a several years of time-savings!

Ocklawaha Mitigation Bank

The Ocklawaha Mitigation Bank, a 208-acre property in the Northern Ocklawaha Basin, Marion County.

Yazoo Mitigation Bank

Meriwether County, Georgia

62 Wetland & 74,912 Potential Stream Credits

Suspended Bank: Needs Restoration for Compliance

Land Not Included in Purchase

Crooked River

Mitigation Bank

The Crooked River Mitigation Bank (CRMB) is 323.10 acre mitigation bank. CRMB requires the restoration and enhancement of 145.93 acres of forested marsh and 83.23 acres of freshwater marsh, restoration of 18.21 acres of wet pine flatwoods, establishment of 34.57 acres of forested wetlands and 36.71 acres of freshwater marsh, restoration of 4.24 acres of adjacent upland buffer pine flatwoods, and preservation of all 323.10 acres within the CRMB boundary.

Neoverde Basin 21

Mitigation Bank

Neoverde Basin 21 Mitigation Bank is a 1,301.19 mitigation bank in Volusia County, Florida. There are currently no other Mitigation Banks permitted in Basin 21, and market demand is strong.

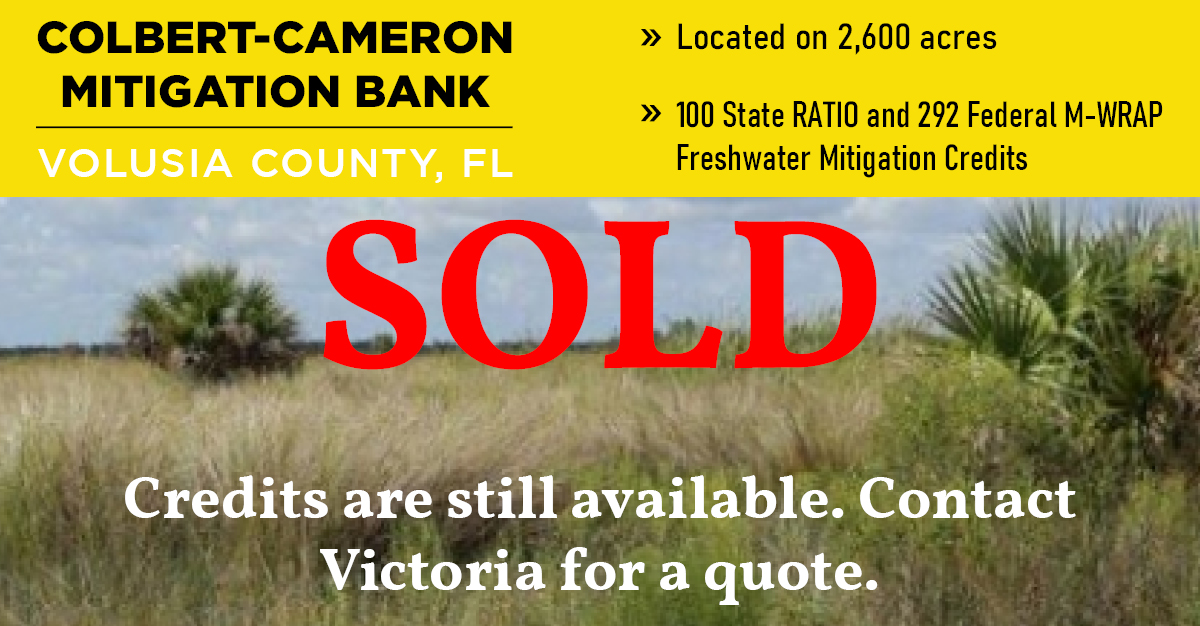

Colbert Cameron

Mitigation Bank

Colbert Cameron Mitigation Bank is a 2,620 acre bank that provides state and federal credits within the St. Johns River (Canaveral Marshes to Wekiva) Basin (Basin 18), Econlockhatchee Nested Basin (Basin 19), Lake Jesup ( Basin 23), and part of the Southern St. Johns River (Basin 20) located within the St. Johns River Water Management District.