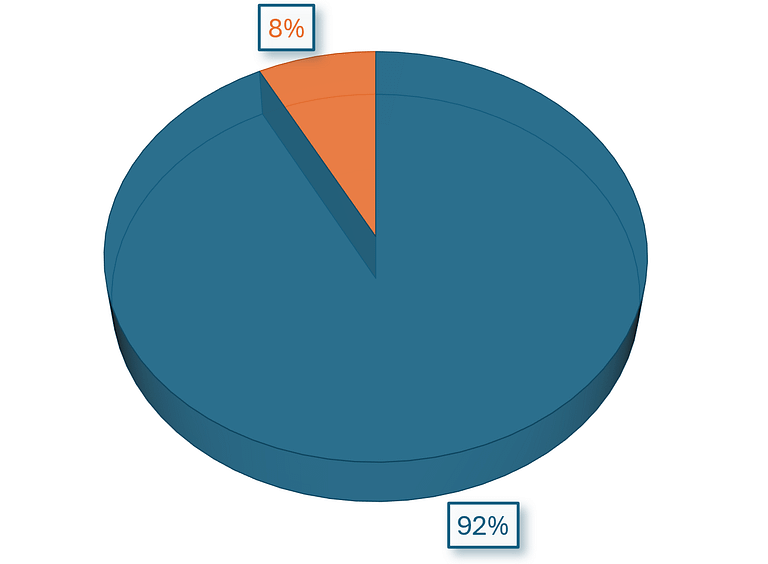

Environmental Mitigation Delivered – Banking Dominates According to USACE Data (National Environmental Banking Association)

Mitigation Bank Credits continue to answer most of the nation’s most pressing environmental challenges – with real environmental restoration – with no temporal loss.

Mitigation bank credits were the mitigation solution 92% of the time from 2015 to 2024 when compared to ILF program withdrawn (released/earned) credits according to U.S. Army Corps data. This new data demonstrates that successful, proven mitigation banks are relied upon to offset unavoidable impacts to our nations water and wetlands – everywhere real environmental offset is the desired outcome.

Prior to the introduction of mitigation banking as a solution for permitted impacts, there was so little transparency that few people outside the industry realized the magnitude of project (offset) failures. In a study by the National Academy of Sciences in 2001, it was revealed that only about half of the required mitigation had ever been constructed and that compliance inspections were rarely done. Projects that had been completed often did not offset the permitted impacts. Severe regulatory staff shortages were common. Thousands of impacts were permitted each year that were never offset. Actual Replacement values were estimated as low as 20%. Tens of thousands of acres of wetlands continued to be destroyed annually. This report and the many mitigation failures, a number of which were highly publicized, ultimately gave rise to the 2008 Final Mitigation Rule.

Environmental banking has demonstrated by thousands of projects across the United States that it is the most successful program in the Nation’s history for restoring and protecting the environment. It is extremely rare for a bank to fail. The industry’s continued expansion presents the very real potential to reverse the continued march of environmental destruction.

Graph shows Mitigation Banks (blue) and ILF Programs (red) 2015-2024 Withdrawn Mitigation Credits from those earned (Released).