From performance-based to post-construction: How to alter the mitigation banking credit release process

A mitigation bank needs “financial assurances” prior to being approved. These assurances act as collateral, ensuring that the bank will meet performance standards and offsetting the risk of investing money in a bank before credits are sold.

As credits are released and sold, the sponsor gets their financial assurances back in turn. The Corps has recently reiterated language from RGL 19-01 that a mitigation bank may get an early release of credits.

What is a mitigation banking credit release schedule?

A credit release schedule is a risk management tool to ensure achievement of mitigation bank objectives and is tied to performance-based milestones. Once a credit is “released,” the bank can sell this mitigation credit to a developer and move closer to solvency. The process of credit release has an impact on credit prices, availability, and investment.

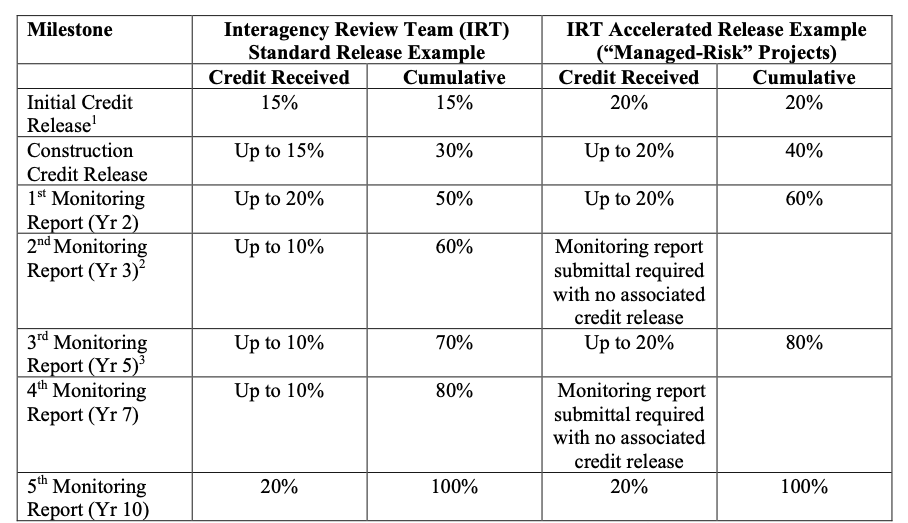

There are 3 phases in the credit release schedule:

- initial credit release,

- interim credit release(s), and

- final credit release.

Interim credit releases are linked to performance-based milestones and released incrementally according to achievements.

The final credits are released once ecological performance standards have been reached.

How to alter the mitigation banking credit release process?

An optional RGL 19-01 credit release moves a large portion of the interim credits from “incrementally” released based on performance to released immediately following the construction phase.

This only happens when a bank sponsor puts up a larger-than-normal financial assurance to ensure meeting performance standards. They have to cover, not only the normal mandate, but also mid-course corrective actions and/or a replacement mitigation bank sponsor if the current one is not willing to take these actions.

Are these early release mitigation bank credits attainable?

The barriers to achievement are high. To cover these large financial assurances, you would need an equal number of credits to cover the amount of credits in this early release and/or also another property where an equal bank could be created to back up your bank if it failed.

In reality, this optional RGL 19-01 early credit release schedule is virtually unattainable.

What does an early release of interim mitigation bank credits mean?

The amount of interim credit releases is tied to the amount of confidence that an assessor has in the likelihood that the bank will achieve ecological performance standards. So, a large amount of interim credits given up front post-construction means the reviewer believes that this bank is a “slam dunk” in terms of success.