Fungible Assets Driving Mitigation Success and Innovation in Florida

In Florida, where rapid development is a constant, the urgency to strike a balance between progress and environmental preservation is palpable. Environmental offsetting emerges as the solution, ensuring that for every detrimental environmental impact, a corresponding positive action restores balance elsewhere.

As industries grow and landscapes change, fungible assets like mitigation credits become essential tools in this endeavor. Through ecosystem marketplaces like mitigation banking, fungible assets play a role in shaping the conservation landscape, driving innovation in Florida and across the globe.

Fungible assets allow for wetland protection

Mitigation credits are fungible assets bought in this thriving ecosystem marketplace for environmental protection and offsetting.

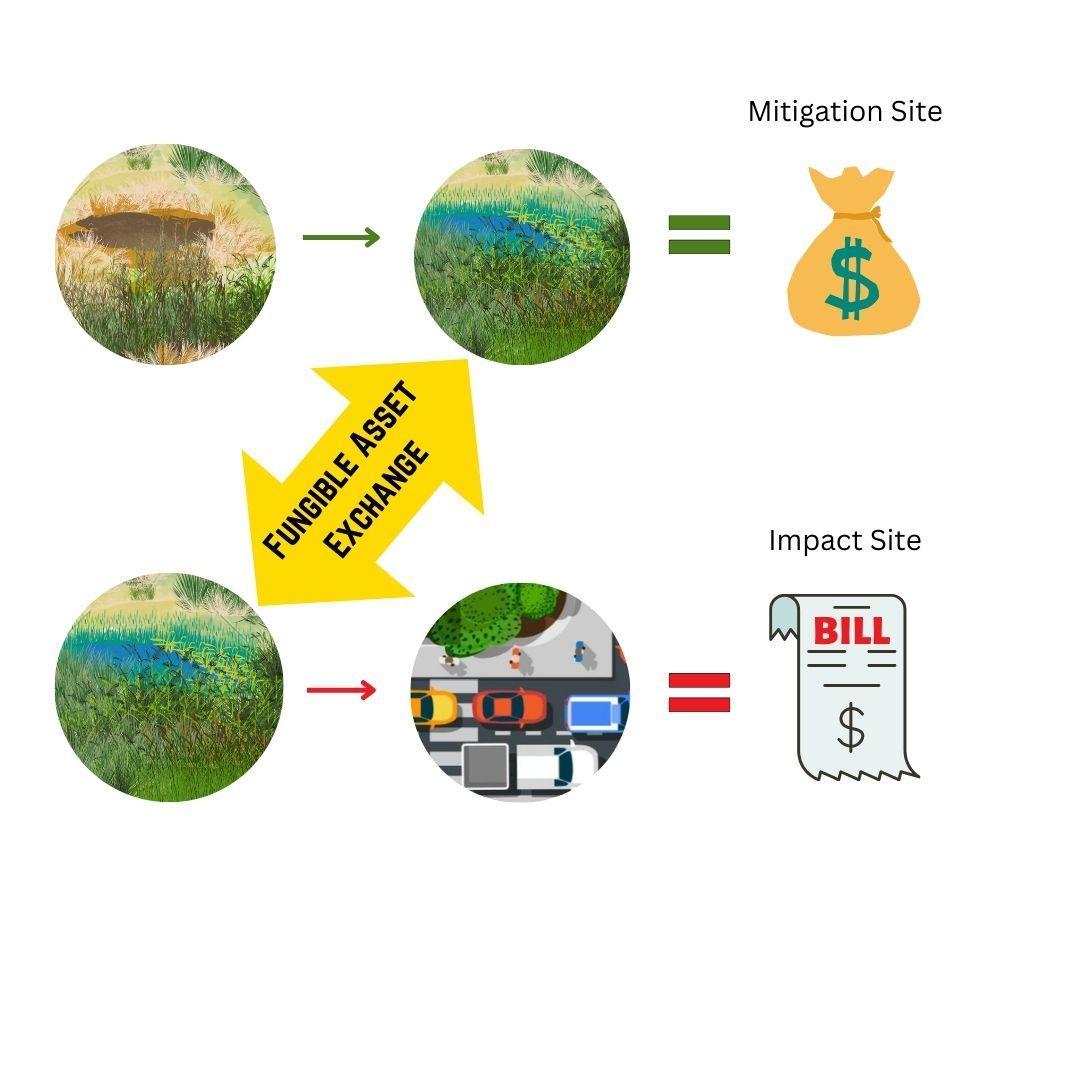

Fungible assets, a term borrowed from more traditional financial markets, are interchangeable with another of the same type and value, making it an ideal tool for environmental offsetting.

When a company causes an environmental impact, these assets can be utilized or traded to ensure a corresponding positive action takes place elsewhere. It’s a tangible method of counterbalancing, ensuring that as industries make strides, they also offset their ecological footprint.

A lot of calculation goes into ensuring loss and gain of function are equal and interchangeable. Mitigation credits are considered fungible assets because of the no net loss policy in mitigation.

Conservation economics, or the valuation of nature for decision-making, allows private equity investments into restoring ecosystem functions. These fungible assets can give return on investment and make the polluter pay–a principle enshrined in climate change agreements worldwide.

Mitigation credits form the backbone of the mitigation banking industry, which has seen remarkable growth and evolution, especially in regions like Florida.

Wetland mitigation as a pioneer in fungible assets

Mitigation banking offsets the pollution of development permitted by the US Army Corps of Engineers and State Agencies. It is regulated by state and federal laws, like the Endangered Species and Section 404 of the Clean Water Act.

The program originated over loss of the wetland ecosystem. It allows for the planning of our built environment alongside the replenishment of our water systems and species habitat.

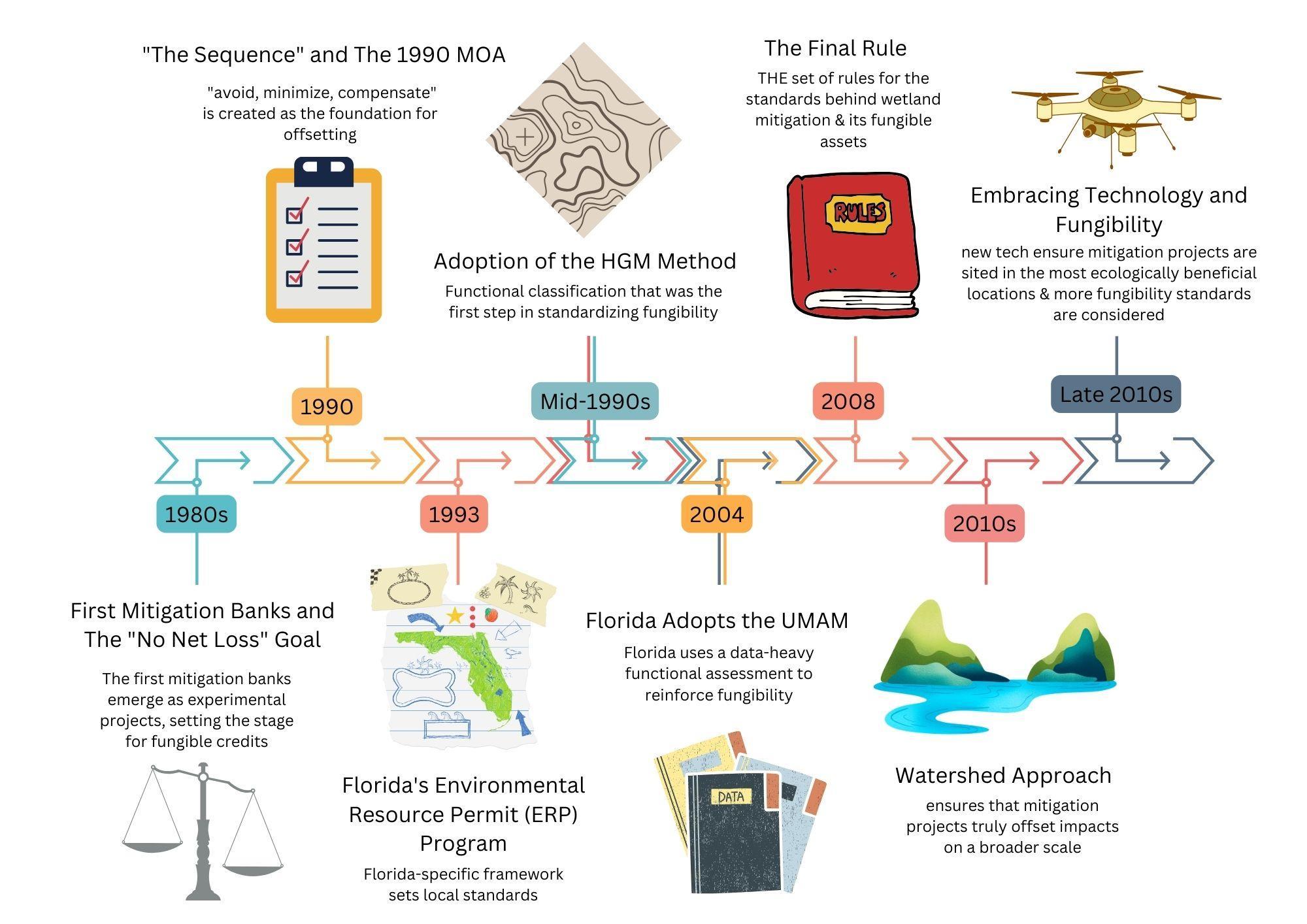

As we trace the journey of mitigation banking, it becomes evident how deeply intertwined it is with the concept of fungibility. Each milestone underlines the industry’s commitment to ensuring that every environmental credit holds consistent and interchangeable value.

This evolution underscores the growing importance of fungible assets in today’s conservation landscape. Mitigation programs have since grown to create fungible assets for habitat loss and water quality metrics, like nutrient levels.

These regulatory measures reflect the evolving relationship between urban planning, environmental conservation, and economics. All of these considerations contribute to what makes a mitigation credit fungible and interchangeable.

Mitigation practices that grow Florida’s banking industry

Private mitigation banking is the only market-based mechanism to complement government policy. Mitigation banking is one mechanism for natural resource management in the portfolio, which includes many government-funded strategies (like the Florida Forever Ecosystem Project, in which state lawmakers spend millions on land for conservation).

The regulations for Florida land conservation are more developed than most states, positively influencing the growth of a private ecosystem marketplace where fungible assets can be traded.

Florida’s progressive water quality practices

Florida has some of the most progressive practices for water quality, with a designated state permitting system that allows the state to force mitigation of water bodies that may fall outside of federal jurisdiction. Stricter standards for water bodies under the Impaired Waters Rule eat up more developable land for use in water quality management in a win for environmental conservation in Florida.

Florida’s pioneering efforts in wetland protection

Florida’s wetlands are also protected by the Florida Department of Environmental Protection (FDEP), which has been in charge of managing the protection of the state’s wetland ecosystems under the Environmental Resource Permit (ERP) program since 1993.

Under the ERP program, any dredging, filling, or construction in or near a wetland must be approved and monitored by the FDEP. Permits allow us to minimize conflicts between users, to prevent unsuitable uses, and to coordinate projects with management activities.

Florida’s unparalleled functional assessment methods in determining fungibility

Florida is also one of the only states that evaluates ecosystems based on the specific functions of each site. This is an evolution from less robust survey methods, like HGM.

This growth shows that the industry can adapt to calls for even more robust data, like the inclusion of ecosystem services in decision-making.

Impacts & successes of mitigation banking and fungible asset trading

At its core, mitigation banking seeks to balance human health and biodiversity by integrating ecological considerations directly into the fabric of development and investment decisions.

The success of mitigation banking is evident in its adaptability, growth, and positive ecological outcomes. These indicators show the dedication and science that go into ensuring fungible exchange of environmental impact and gain.

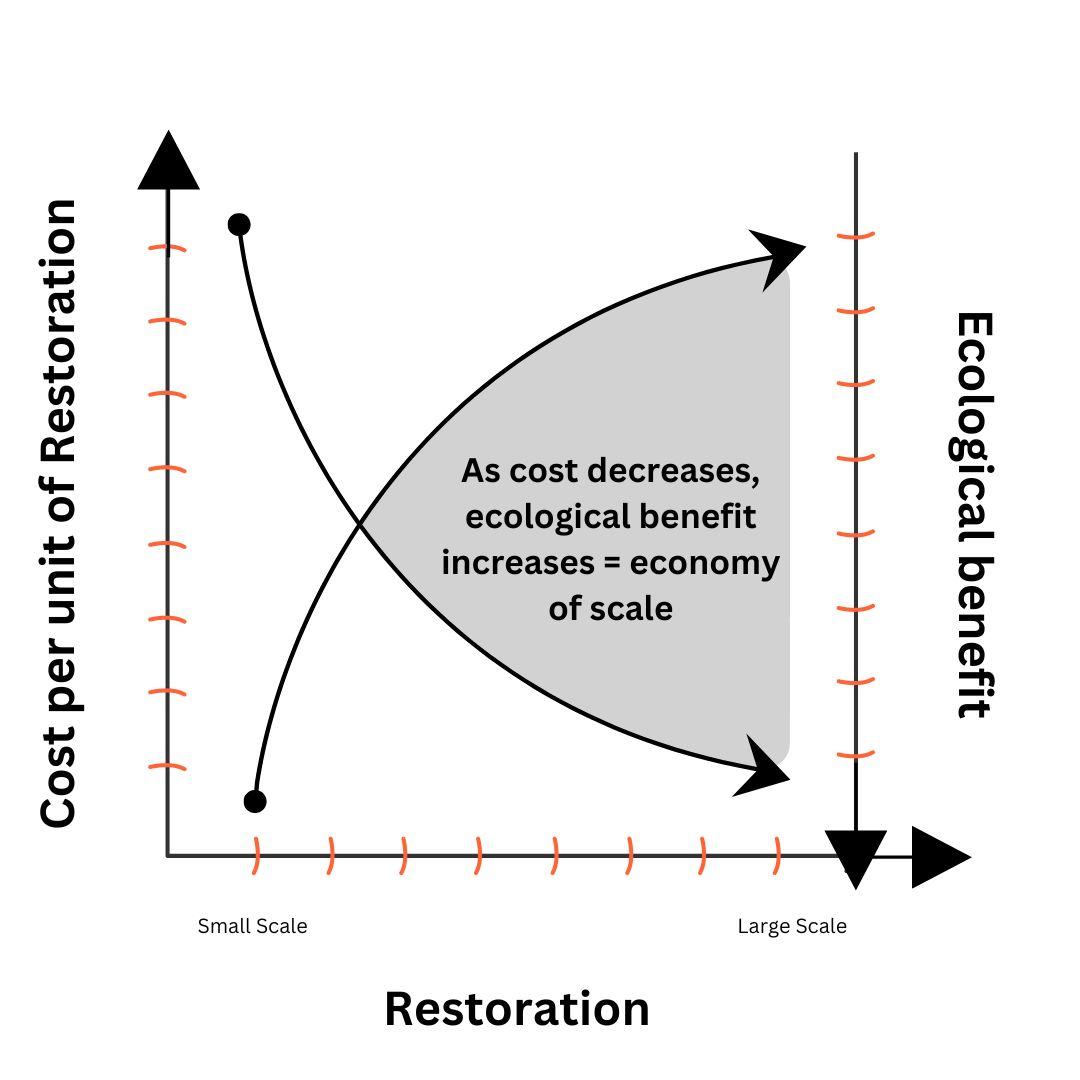

Mitigation banking creates economies of scale for restoration

Mitigation banking is large-scale restoration, creating economies of scale. These economies make it more affordable and therefore feasible to restore and conserve wildlife corridors and connected ecosystems.

This is ecologically beneficial as larger, connected habitats often support greater biodiversity and are more resilient to threats compared to smaller, fragmented habitats.

As projects scale up, the cost per unit in mitigation banking drops. This makes each mitigation credit more efficiently produced and emphasizes its role as a truly interchangeable, or fungible, asset in the balance between development and conservation.

Higher rewards for greater restoration

There are different levels of stewardship and engagement within mitigation banking–restoration, creation, preservation, and enhancement of the targeted ecosystem. The mitigation crediting system rewards restored wetlands with more credits than preserved wetlands. The sale price of credits is also generally higher. This incentivizes restoration, which is in fact seen to have a “net gain” of wetland function.

Steady preservation & the growth of more land stewardship

Preservation has been the predominant method of mitigation from 1995 to 2020. However, restoration of ecosystems has rapidly increased over that same period. Preservation is an important part of the conservation banking framework, preserving habitat for endangered species.

The mitigation banking industry adapts to evolving perspectives

Prior to its creation in 1970, policies encouraged the destruction of wetlands. Because they are a habitat for mosquitoes, they were a source of mosquito-borne illnesses. With modern medicine, this is no longer a concern. A framework for mitigation banking put a stop to this rapid ecosystem loss. This young industry shows room to grow and adapt to a modern set of challenges.

The industry has since shown that it continues to be capable of adapting to new information. The National Research Council wrote the Watershed Approach to affect a change in the policy, and the Corps of Engineers, recognized the wisdom and altered the procedure. Its periodic technical guidance from the USACE is continually updating and altering the policy guidance.

The collaboration on regulations and methodologies not only addresses community and environmental concerns but also ensures that mitigation credits maintain their fungibility. As standards become clearer and more consistent, their interchangeability and equivalency are better upheld.

Mitigation banking creates opportunities in the restoration economy

Mitigation banking is a path for a landowner, passionate about stewarding the health of the environment. The “restoration economy” gives value to otherwise degraded land. It rejuvenates areas with low economic opportunity.

This is an opportunity for a green return on sustainable and responsible investment. There is a big competitive advantage to getting into this market. Fungible assets for other degraded ecosystems are growing with seagrass mitigation on the horizon.

Conservation easements ensure functional, fungible ecosystems

In effective restoration, it’s the management practices that matter. Regulations require that mitigation banks have a conservation easement, which ensures a functional ecosystem for perpetuity. This easement ensures fungibility in the long run, fulfilling the promise of an interchangeable, equal exchange between loss and gain.

Flexibility and the true essence of fungibility

One of the remarkable successes of mitigation banking lies in its inherent flexibility. Lands initially allocated for industrial usage can, over time, transition back to public conservation, like when the Department of the Interior purchased the conservation easement for over 38,000 acres of formerly private timberlands. Through a series of acquisitions, lands that were originally mitigated by a timber company were repositioned for public conservation, ensuring long-term environmental benefits while still allowing industries to thrive in the short to medium term.

These lands, based on their usage, have varying ‘values’ or purposes over time. Their ability to change roles, facilitated by the trading of fungible assets, highlights the true potential of fungible assets in environmental management

Innovations and advancements in environmental management

As mitigation banking evolves, a blend of technology, innovative strategies, and collaborative approaches reshape its landscape. More innovations and advancements allow us to more accurately ensure the fungibility of our mitigation credits.

The seriousness with which mitigation banking takes fungibility is a reflection of how we value wetlands and our endangered species. As a result, we look to the ways that the use of wetlands can grow in our and other sectors.

Integrating technology for targeted, data-driven decisions

New technological tools, like GIS mapping and remote sensing, allow for a landscape-based approach to mitigation. This advancement considers the whole picture.

It takes into account topography, groundwater, historical ecosystems, and human settlement. These factors are overlaid with environmental stressors, like flood-prone areas, inside of one map with many layers. These advancements can change the game in environmental management and allow for more targeted protection and mitigation strategies.

Fungible assets stacking could result in better ecological outcomes

The growth of ecosystem credits allows private land restoration to group transactions targeting multiple species or ecosystems within a project site. This strategy results in higher rates of ecological and ratio equivalency. The ability to stack fungible assets could result in a variety of ecological offsets in one site.

Green techniques in best practices for construction

Prior to granting permits for wetland loss, the government requires development to first avoid and then minimize any impacts. To help this, they supply common best practices for development. These common best practices could include climate-smart infrastructure, even pervious pavement, as recommendations.

With smart design, mitigation banks can serve a variety of other functions. They can be combined with nature-based solutions for climate adaptation, like constructed wetlands as a greywater recycling system.

Mitigation banks integrated into state action plans

Coordination between government climate change adaptation plans and mitigation banking can align these systems. Miami-Dade County’s Sea Level Rise Strategy calls for the expansion of greenways and blueways in urban areas.

Mitigation banks as part of urban design

Mitigation banking can be used as a mechanism for green urban infrastructure, and in fact already has been used that way in Pennsylvania and California. Not only does it better protect the urban infrastructure, it also lasts longer than more conventional methods of coastal construction.

Mitigation banks as part of corporate insetting

This is an opportunity for investment firms that want green return in their sustainable and responsible investment for their environmental, social, governance guidelines to move money into the restoration economy.

Calls for companies to invest and de-risk mitigation banks as part of an “insetting” strategy is another way the market is innovating.

Mitigation banking bridges the gap between private & public conservation with fungible assets

Mitigation banking is one of many solutions employed to move big systems on environmental management, and one of the only ones on the market side. This industry bridges the gap between private equity, degraded land, and human development.

Mitigation banking is an incredibly useful tool to fund private land stewardship as part of an overall strategy for environmental management.

Fungible assets are the future of balanced growth

The challenge of managing urban growth while protecting the environment is significant. However, the mitigation banking industry, backed by the utility of fungible assets, provides a practical model. Florida’s approach serves as a case study, showcasing how strategic conservation efforts can align with development goals. As we look ahead, the role of fungible assets, especially in regions facing rapid development, will only grow in importance.