Clean Water Act in Florida The recent ruling by the U.S. Supreme Court in Sackett v. EPA has sparked concerns about the future of wetlands protection in Tampa Bay, Florida. This decision redefines the scope of protected wetlands under the Clean Water Act, with isolated wetlands now exempt from federal protection. We explore what this decision means for Florida’s environment and the stance of various stakeholders, drawing insights from the original article by Jack Prator from the Tampa Bay

National Wetland Inventory Wetlands are vital resources for habitat and water quality. To protect them for future generations, the state and federal agencies requires people who plan to remove or add material to wetlands (or waterways) to get a permit. But how do we determine if a patch of land is a wetland? The National Wetlands Inventory (https://fwsprimary.wim.usgs.gov/wetlands/apps/wetlands-mapper/) is the best place to start for approximating where wetlands might be located. However, sometimes onsite assessment by a qualified wetland professional is

Mitigation Banking Industry Insights: U.S. House of Representatives Encourages Streamlined Approval of Bank Credits Last week saw significant developments in the mitigation banking industry as the full Appropriations Committee approved the U.S. House of Representatives FY2024 Energy & Water Development Appropriations Report. A notable section of the report underlines the potential of mitigation banks to expedite project delivery. Highlighting the Potential of Mitigation Banks According to the approved language in the report, the Committee acknowledges the promise mitigation banks hold for accelerating project

In many ways, the mitigation banking industry is one of the first environmental markets, as well as one of the pioneers of offsetting and ecosystem valuation. Looking at how we have done it gives a foundation from where things will grow. As the oldest environmental market in the United States, our methods for environmental valuation is a good place to start that understanding. We used to get rid of wetlands, what changed? Our understanding of the importance of

How much does it cost to Permit a Mitigation Bank? The cost of permitting a mitigation bank can vary widely depending on several factors, including the size and complexity of the site, the scope of the proposed restoration activities, and the specific regulatory requirements that apply to the project. However, it is generally recognized that the cost of permitting a mitigation bank can be substantial! According to the USACE, the cost of developing a mitigation bank can range from $500,000.00-$5 Million, depending

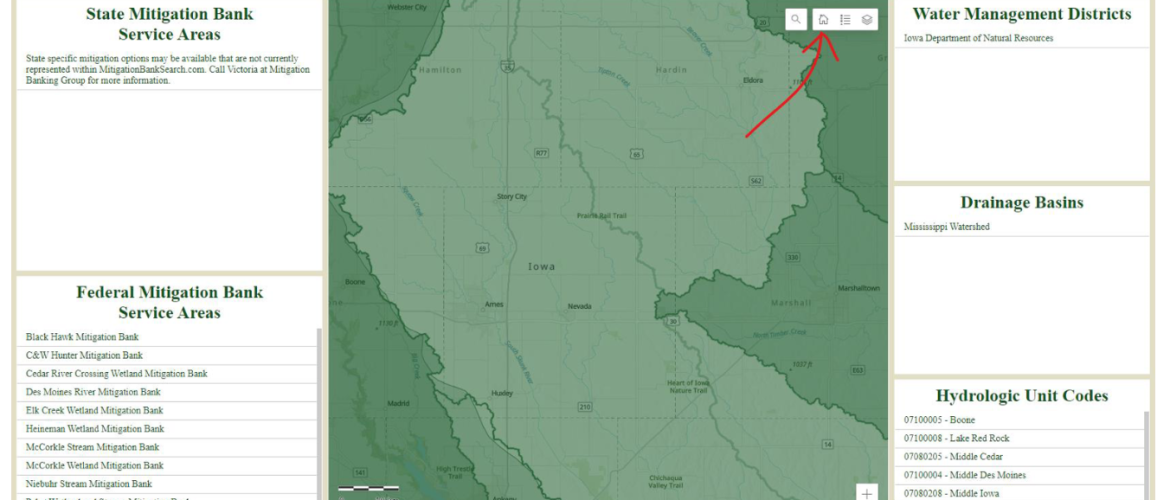

About MitigationBankSearch.com Have you just bought a property that you were hoping to build on and found that a wetland habitat is on the property? Is a regulatory agency telling you that you will have to calculate the impacts that your development will have on the wetland and that you will have to purchase mitigation credits for those impacts? Mitigation Banking Group simplifies the process, explaining the steps to take and help you purchase those mitigation credits from the right place. These steps

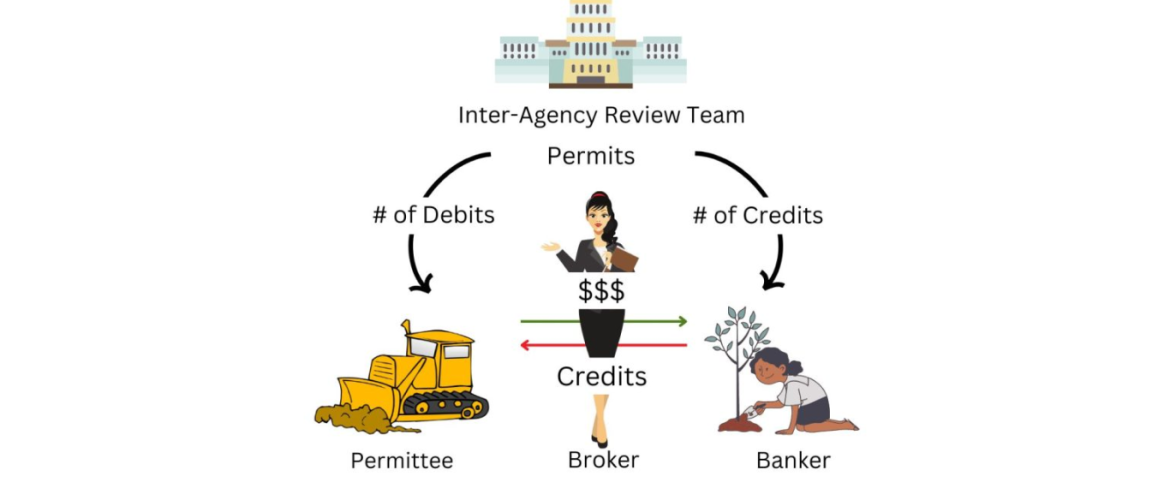

Mitigation Banking Made Easy: Why You Need a Credit Broker on Your Side Mitigation credit sales brokers play a crucial role in the industry. They connect buyers and sellers, negotiate credit sales, and ensure compliance with regulations. Whether you’re a banker, a developer, or an investor, working with a sales broker can help you. They navigate the complex processes of buying and selling credits, and buying, selling, or starting a mitigation bank. By utilizing their knowledge and expertise, you can save time

UMAM and WRAP Scoring Guidance

What are the determining factors to find out the quality of a wetland?

UMAM SCORING GUIDANCE: THE SCORING OF EACH INDICATOR IS BASED ON WHAT WOULD BE SUITABLE FOR THE TYPE OF WETLAND OR SURFACE WATER ASSESSED

Optimal (10)

Condition is optimal and fully supports wetland/surface water functions

Moderate (7)

Condition is less than optimal, but sufficient to maintain most wetland/surface water functions

Minimal (4)

Minimal level of support of wetland/surface water functions

Not Present (0)

Condition is insufficient to provide wetland/surface water functions

Get the Lowdown on Credit Types and Mitigation Credit Classifications Mitigation credit types refer to the type of mitigation being used, while credit classifications refer to the level of ecological value and function provided by the mitigation site. Together, these concepts help to ensure that mitigation credits are used in a way that effectively offsets the impacts of a project while also protecting and enhancing the environment. These classifications bridge the gap between the scientific and regulatory world.

A Review of Compensatory Mitigation in Estuarine and Marine Habitats We are excited to share that the report has been published on EPA’s website. Desk statement: EPA developed “A Review of Compensatory Mitigation in Estuarine and Marine Habitats” to inform regulators, mitigation providers and the public about compensatory mitigation in estuarine and marine settings. The report explores four habitats: shallow water, seagrass, oysters, and tidal flats (mudflats); it describes each of the habitats’ importance and provides examples of mitigation and