Wetland Mitigation Law and Procedure Webinar On April 11, 2024, professionals across various environmental disciplines are gearing up for the Wetland Mitigation Law and Procedure webinar. This webinar is a great way to gain knowledge, insights, and innovations from leaders in wetland science, mitigation banking, and environmental law. Complete the form to access the webinar. hbspt.forms.create({ region: "na1", portalId: "6970733", formId: "2a0d0d5c-d461-4b35-83ad-dced7741e90f" }); Wetland Science and Wetland History in the

The Future is Green: Unpacking the 2024 Global Outlook for Environmental Consulting Services In a landscape where environmental sustainability becomes increasingly paramount, the Global Environmental Consulting Services Market stands as a testament to the sector’s burgeoning demand and potential. Estimated at $35.7 billion in 2022, the market is on a trajectory to reach an impressive $65.1 billion by 2030. This anticipated growth, averaging a 7.8% CAGR, mirrors the escalating global commitment to addressing environmental challenges through expert consulting services. Central to this

Navigating the Evolving Landscape of Wetland Mitigation Banking in 2024 As we navigate the complex and ever-evolving world of wetland mitigation banking, understanding the intricacies of this field is crucial for both environmental preservation and sustainable development. In a comprehensive article by Charles Boisseau, the nuances of mitigation banking, its impact on real estate, and the challenges faced by bankers and developers in Florida are thoroughly explored. From the historical evolution of wetlands management to the current market trends and regulatory frameworks,

Join The Mitigation Banking Group in fostering a sustainable future for Florida’s landscapes. Discover our quest for partners in mitigation banking, from active site managers to investors. Let’s collaborate for ecological and economic balance.

Learn how UMAM evaluations determine the condition of wetland communities. Discover how these scores influence your need for wetland mitigation credits and what steps are essential before you proceed with any development projects.

From water quality to habitat preservation, learn how the Three Pillars of ‘No Net Loss’—Life, Land, and Chemistry—shape wetland health and contribute to effective watershed management.

Florida plans to increase wetland mitigation banks, and the Mitigation Banking Group is at the forefront of this exciting trend. Learn why more banks are crucial for balancing environmental preservation and economic growth

Discover key insights into the mitigation bank approval process in our latest joint report with EPIC. The Phase II analysis reveals bottlenecks and provides actionable recommendations to streamline approvals. In-depth interviews with 19 mitigation bank sponsors included.

Fungible Assets Driving Mitigation Success and Innovation in Florida In Florida, where rapid development is a constant, the urgency to strike a balance between progress and environmental preservation is palpable. Environmental offsetting emerges as the solution, ensuring that for every detrimental environmental impact, a corresponding positive action restores balance elsewhere. As industries grow and landscapes change, fungible assets like mitigation credits become essential tools in this endeavor. Through ecosystem marketplaces like mitigation banking, fungible assets play a role

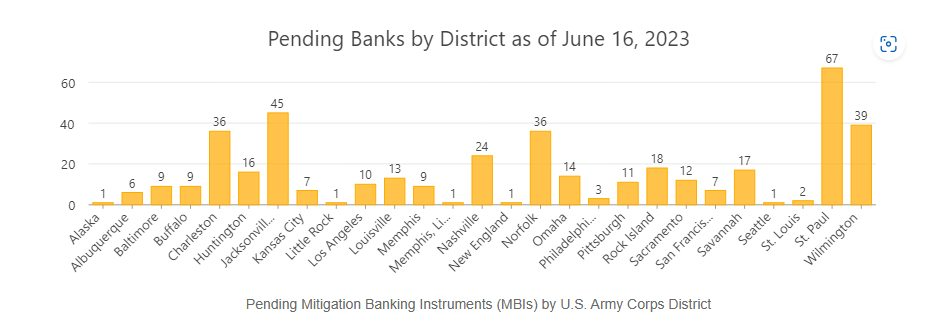

The National Environmental Banking Association (NEBA) has recently alerted senior government officials and industry that more than two years of persistent regulatory slow-downs and few Mitigation Banking Instrument (MBI) approvals by the U.S. Army Corps Mitigation Program has led to a significant backlog of projects without needed go-aheads to conserve, restore and protect. This graph displays the 419 Mitigation Banks currently awaiting approval by the Corps/IRTs across the various Districts. Some of these MBI’s have been pending for as much as