Mitigation Banking 101: How Does Mitigation Banking Work?

Mitigation banking is a market-based solution to natural resource management. The industry moves private equity, and not taxpayer money, into ecosystem preservation and restoration. The program originated over loss of the wetland ecosystem and has since grown to mitigate habitat loss for endangered species and water quality metrics.

Mitigation banking is one mechanism for management in the nature resource portfolio, which includes government-funded strategies and other private efforts to restore ecosystems.

Understanding the basics of mitigation banking

Mitigation banks are large-scale restoration and enhancement projects established in areas where continued development impacts important aquatic resources.

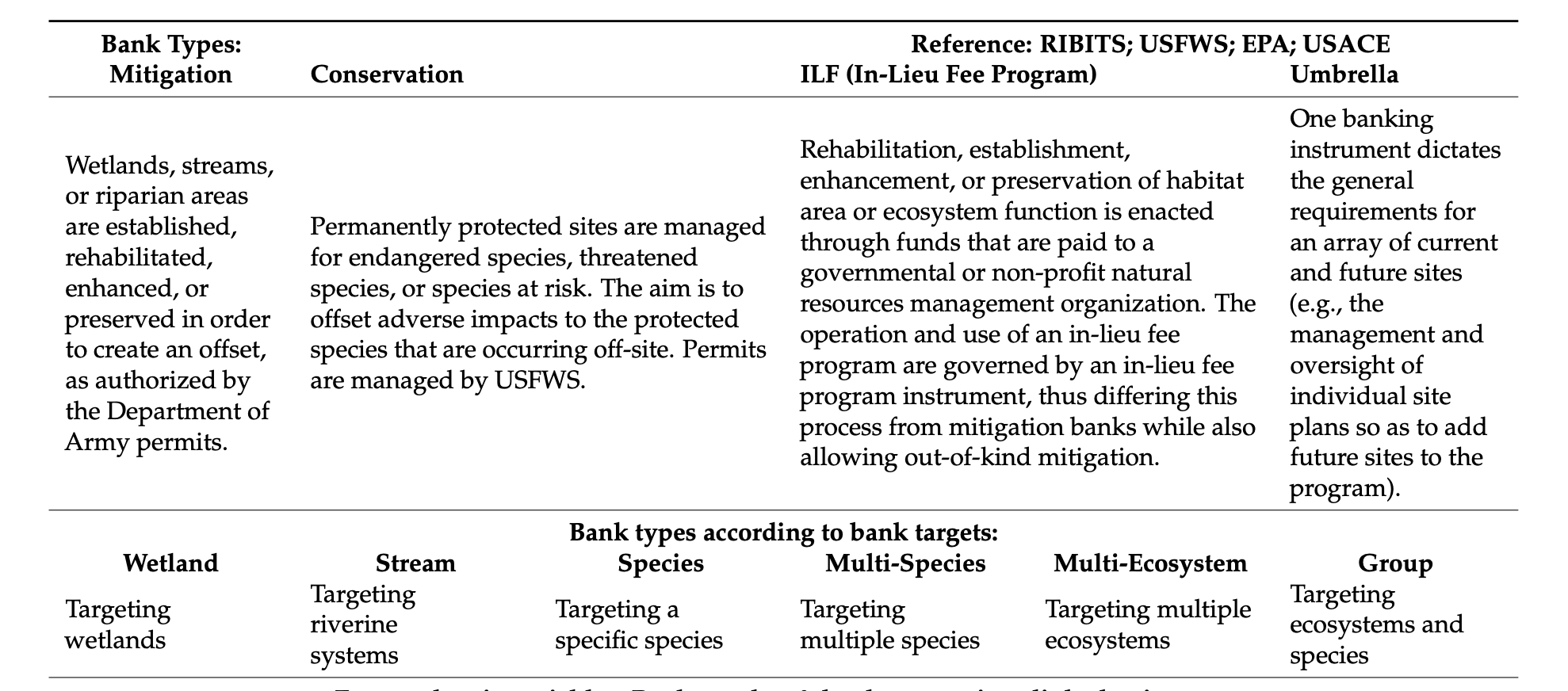

Banks can be categorized by who “sponsors” them, i.e. public, private, or non-profit banks. They can also be categorized by the type of restoration activity taking place, i.e. preservation, creation, enhancement, or restoration banks. They can also be categorized by the credit type that they generate.

There are many different credit types. They fall into broad categories, like stream credits, forest credits, wetland credits, and species credits, to name a few. Inside of those categories, they are further broken down by other ecological characteristics. Credits are also defined by which level of government legislates the activity, state or federal.

- Wetland mitigation banking restores degraded wetlands, helping aquifer absorption and stormwater management in an area that previously was not functioning optimally.

- Conservation banking enables money to move into private management of endangered species by preserving or restoring the habitat of an endangered animal in Florida.

What is compensatory mitigation and other mitigation standards?

For simplicity, compensatory mitigation is a biodiversity offset. What mitigation bankers are selling is a grouping of ecosystem functions that take place inside the boundaries of their bank, including things like carbon sequestration, nutrient cycling, and biomass. A bank owner can restore, preserve, enhance, or create the targeted ecosystem.

Compensatory mitigation is the final stage in the process of mitigation hierarchy, also known as sequencing. When environmental impacts can not be avoided or minimized any further, they can be offset, or compensated for, with the purchase of a credit.

Mitigation banking is based on the core concept of “no net loss.” Any loss of ecological and environmental services as a result of development will be fully mitigated by the mitigation bank. Regulators try to ensure this standard with service areas, crediting methodology, and the timing of when mitigation takes place.

Why was compensatory mitigation banking started in the first place?

Prior to its creation in the 1990’s, policies encouraged the destruction of wetlands, believed to be harmful because they are a habitat for mosquitoes. There were no effective medicines for illnesses carried by mosquitoes, like malaria. So they were hazardous to humans.

Now, this is no longer the case. In fact, aquatic habitats with insect life are vital for sustaining fisheries, one of the many services we receive from wetlands. Altered regulations and a strategy for mitigation banking put a stop to this rapid ecosystem loss. The success of this program has led to expansion into many credit types and is growing.

What are the regulations and guidelines of mitigation banking?

Mitigation banking offsets the impact of development and infrastructure projects permitted by the US Army Corps of Engineers. It is regulated by state and federal laws, namely the Endangered Species Act and Section 404 of the Clean Water Act. USACE releases periodic Regulatory Guidance letters adapting the industry to emerging technology, ecological data, and urban planning needs.

Florida has its own set of state policies that allow it to manage watershed and water quality alongside the federal mitigation requirements. The technical aspects of mitigation banking are regulated through the US Army Corps of Engineers (USACE) and the Water Management Districts (WMD) that your project falls within or The Florida Department of Environmental Protection (FDEP). There are Five Water Management Districts in Florida:

- South Florida Water Management District (SFWMD),

- Suwannee River Water Management District (SRWMD),

- North Florida Water Management District (NFWMD),

- St. John’s River Water Management District (SJRWMD) and

- Southwest Florida Water Management District (SWFWMD).

Regional Water Management Districts take part in permitting both development projects and the establishment of mitigation banks. These agencies provide guidance, authorize establishment of and certify compliance of mitigation banks within their jurisdiction to guarantee that the restoration and enhancement efforts associated with a mitigation project are carried out successfully before credits are released to be sold.

The same agencies that set standards for a mitigation bank also set the permitting standards for development and are often referred to as the Inter-Agency Review Team.

A look at the mitigation banking market fundamentals

Mitigation finance comes from a variety of public, private, environmental sectors that fund the mitigation bank and conservation easement, and make money on the sale of credits. Permitted projects buy a set number of credits from mitigation banks and the bank sponsor is rewarded when the sale goes through.

Mitigation credits are part of a thriving ecosystem services marketplace that makes the polluter pay, a principle enshrined in climate change agreements worldwide.

The Florida Department of Environment defines the major players in the mitigation banking industry as:

- Credit sellers:

- Banker: person or group running the mitigation site / long-term steward

- Bank Sponsor: the upfront costs of establishing a mitigation bank are significant and sometimes an entity provides the funding

- Credit Buyers:

- Permittee: impact permit applicant

- Regulatory agencies:

- Reviewer: agency responsible for evaluating the necessity of any proposed impact and the steps taken by the developer to first avoid and minimize this land use change.

- Agency: agency responsible for approving the mitigation bank instrument and site plan for establishment of the mitigation bank. They also hold the bank ledger, releasing credits as performance milestones are met and marking down credit sales to keep an accurate ledger of the environmental credits.

Environmental consultants design the restoration or preservation plan for a mitigation site. They may also be involved in the long term management of that mitigation bank. They will also be involved on the other side of the coin, with assessing the potential impact of any projects seeking a permit for planned impact.

Mitigation credit sales brokers provide a key role in managing parts of the mitigation workflow in due diligence of the credit market for both credit and land sales. They are knowledgeable of both sides of the market, and as a result can advise on planned infrastructure projects or availability of in-kind and in-basin credits.

How do mitigation banking credits work?

The restoration work completed at a mitigation bank generates a net gain of aquatic resource function, i.e. wetlands or streams, or habitat in a given area, creating a credit. A planned impact on a permitted site represents a debit.

The amount of credits awarded to the bank is based on a functionality assessment. The mitigation bank owner can then sell those credits to a developer. The value of the credits is based on the forces of the private market.

The amount of credits debited to a developer is also based on a functionality assessment. However, the metric is also subject to a comparison called a mitigation ratio. This ratio compares the loss of function at the developers’ site to the functional gain previously awarded to the proposed bank for mitigation.

Each regulatory district has a set of approved worksheets that are used to calculate the number of credits a bank generates and credits required for project impacts, serving as a basis for ensuring that the improvement each credit provides at a bank is equal to (or greater than) the loss associated with each credit required for a given project.

Predetermined service areas create a map and dictate whether the mitigated activity benefits the ecology of the area where the impact takes place.

Who owns compensatory mitigation banks?

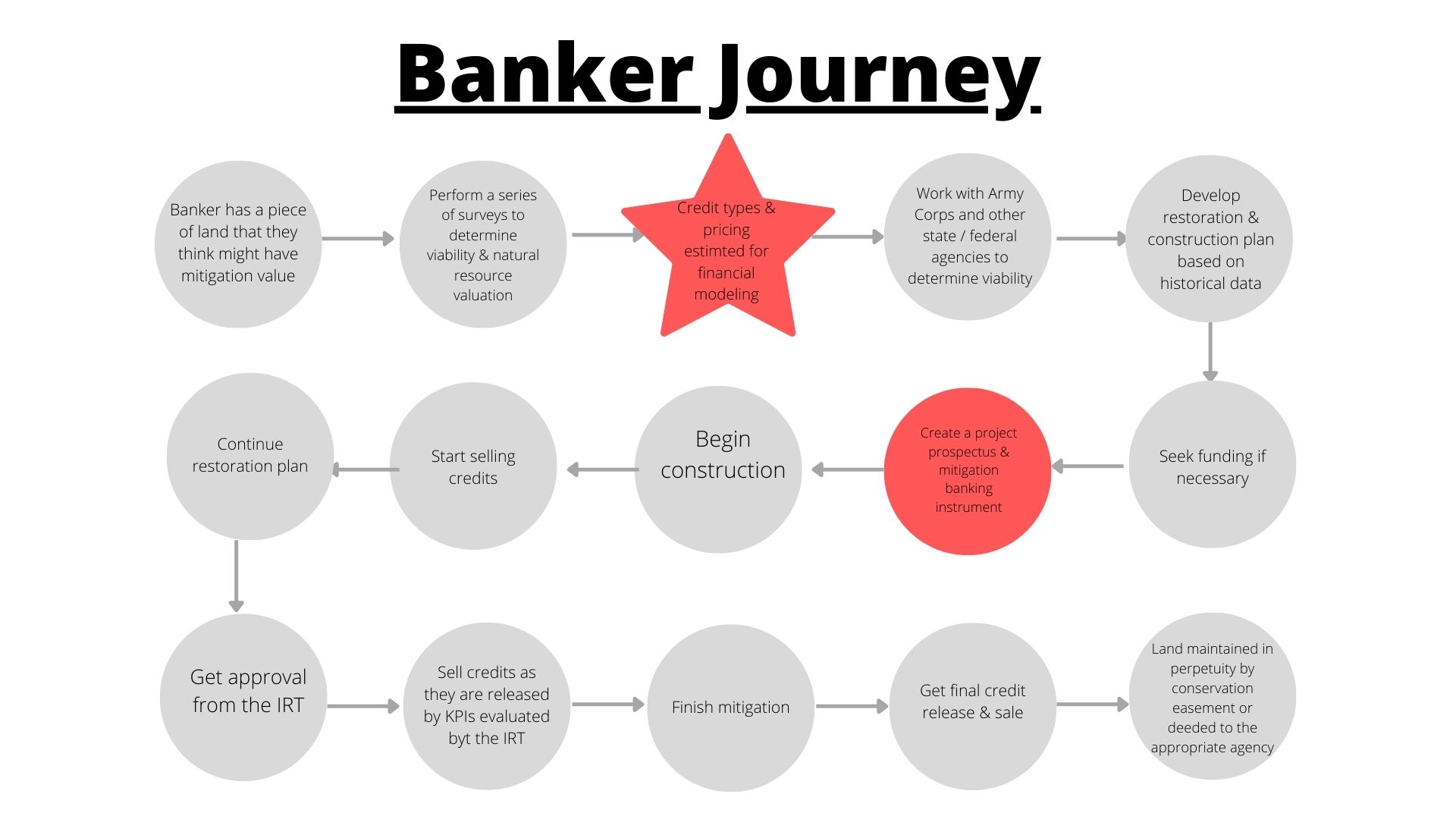

Mitigation banking is a path for a landowner, passionate about stewarding the health of the environment. Bankers need to have enough financial assurances, an adaptive management plan, and realistic restoration plans before approval. Regulations require that mitigation banks have a long-term fund, conservation easement, to ensure that the land has the means to be managed as a functional ecosystem for perpetuity.

A credit release schedule awards credits as milestones in the bank construction and performance are met.

Typical mitigation bankers are:

- Landowners: own land, maybe they use the land for farming or have property there and are enticed by extra property value

- Companies: market the mitigation credits and develop the banks

- Public/civil society: have public lands and want to capitalize on this

- Nonprofits: in-lieu mitigation banks have different timing for credits, types of funding, etc.

- Investors or speculators: have a large amount of capital to put into buying property just to mitigate

- Entrepreneurs: convince investors they can deliver return on investment with an eco-asset

Management is a key factor of success in mitigation banking because it helps set a realistic and well funded conservation easement. Credit pricing is necessary for setting an accurate budget as a developer in the feasibility phase of planning. For both of these things, a broker’s knowledge of historical pricing is invaluable.

They also help investors determine the most lucrative properties for siting wetland mitigation or conservation banks. For someone looking to sell or buy a permitted mitigation bank, Mitigation bank brokers sell mitigation properties.

Who needs to buy mitigation credits?

Mitigation may be necessary for development as large as a new airport and as small as a driveway. The basic characteristic of mitigation-worthy activities is the movement of earth. This means dredging sediment out of wetlands, streams, lakes, rivers, etc. It also means filling material into the same ecosystems to stabilize the land enough for construction to take place.

Infrastructure and construction on causeways, roadways, dams, dikes, artificial islands, riprap, groins, revetements, seawalls, breakwaters, plus site fill for any recreational, commercial, residential, industrial, or other use may all be subject to purchasing mitigation credits.

Typical buyers are

- Construction companies & development companies: want to build something somewhere and need to offset the impact

- Government infrastructure: wants to build and need to offset the impact

Siting development projects where there are available credits makes the permitting process go more smoothly, and it is recommended to pre-consult over mitigation requirements early in the planning process.

Development projects that involve wetland impacts require permits from the applicable regulatory agencies before construction can begin. The number of credits required, based on the size of the impact, must be purchased before a permit is considered to be fully authorized.